Get the latest climate technology news directly to your inbox.

Why battery storage is key for energy independence in Texas

The technology could propel the Lone Star State to lead the country in renewable energy.

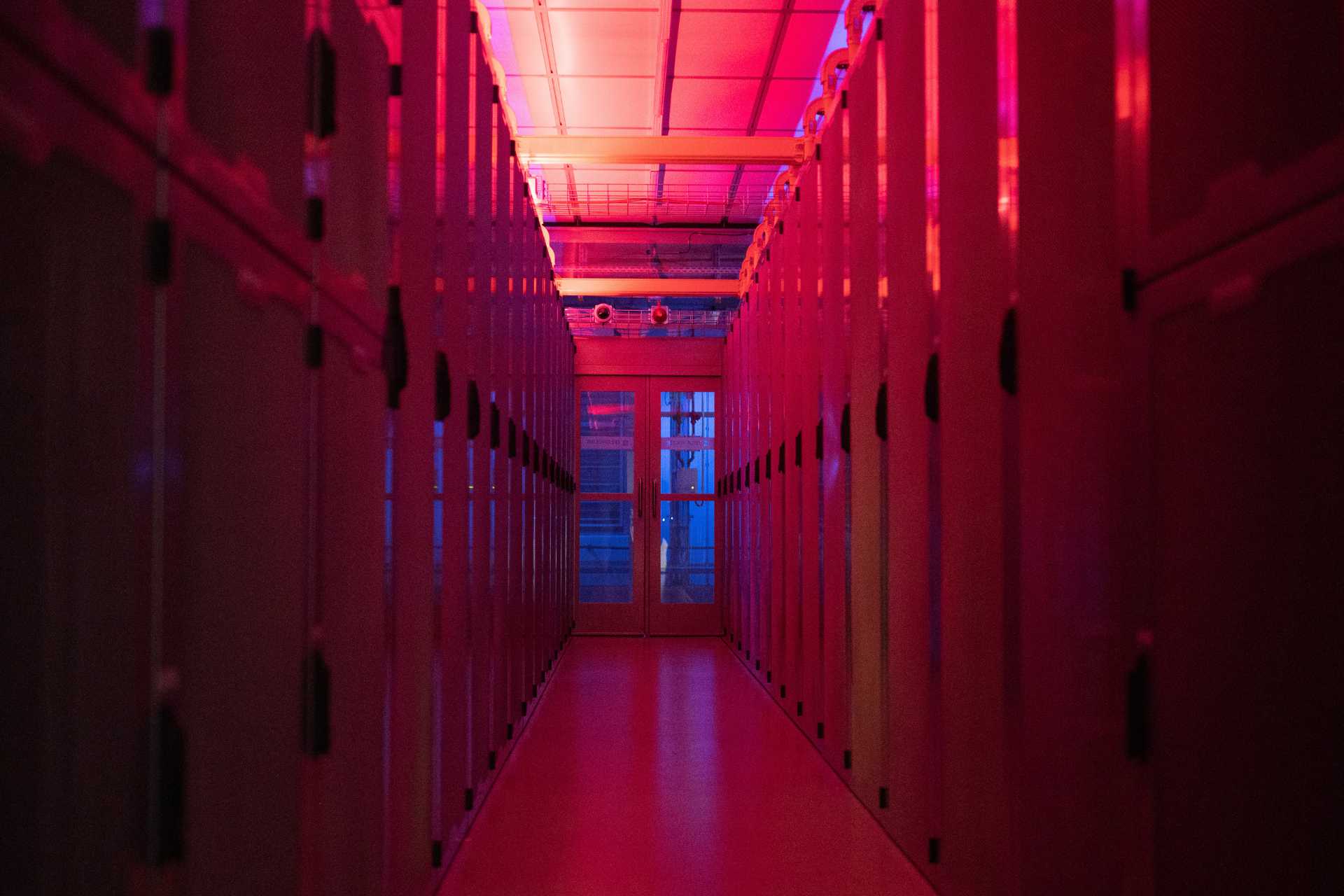

Photo credit: Brandon Bell / Getty Images

Photo credit: Brandon Bell / Getty Images

Texas’ energy grid is experiencing a technology revolution.

The age of battery electric storage systems arrived virtually overnight, growing from only 275 megawatts in 2020 to more than 3,500 MW operating today. By the end of 2024 that number is expected to grow to over 10,000 MW.

And an eye-popping 115,000 MW of storage is currently being processed in the ERCOT interconnection queue, accounting for almost 40% of the country’s entire storage pipeline. Even if only 20% of this capacity comes online, Texas would have 23 gigawatts of storage by 2026 — a much-needed boost of dispatchable capacity for a grid stretched to its limit.

The storage gold rush in Texas is driven by massive load growth, rapid deployment of variable renewable generation, the state’s relative ease of interconnection to the grid, and a wholesale energy market construct where price volatility is a feature, not a bug. The huge value of this technology to the Texas grid and economy should be acknowledged by encouraging its deployment through policymaking and market rule development.

Keeping the lights on

Demand for energy in Texas is booming. With rapid population growth and electricity-intensive businesses such as data centers arriving daily, ERCOT’s load has grown 14% over the last two years alone. In the summer of 2023, ERCOT set 10 new peak demand records.

Today, the role of storage in the grid’s capacity is small. For example, during the record peak on August 10, storage provided about 1,200 MW of discharge at 7:00 PM, about 1.6% of total demand. The rest of the storage fleet served ancillary services markets such as regulation, freeing up thermal generation to provide capacity.

Going forward, though, storage is poised to take on a much bigger role in maintaining reliability. Let’s look at the interconnection queue.

ERCOT, which was already the number one energy market for wind energy, recently passed California to become the number one market for solar as well. Together, solar and wind are expected to reach 43% of the state’s overall installed capacity by 2035.

The market has clearly spoken: solar and storage are the most economic resource additions through 2030. Recent efforts to encourage new gas generation notwithstanding, ERCOT will have little choice but to rely on storage to meet the significant load growth that shows no signs of abating.

The following chart shows ERCOT’s average generation in July 2023.

Wind typically declines in the morning through midday — i.e. when solar peaks — and then picks up in the evening. So in those evening hours , there is a compelling economic opportunity for storage to take a handoff from solar and pass it on to wind overnight.

However, the minute-by-minute realized wind output is highly volatile. On average, wind generation reaches its minimum between 3 and 6 PM, but on some days the wind hardly blows at all, as shown on August 15th. Storage is a critical companion to renewables, as it acts as a hedge against renewable volatility — while also avoiding unnecessary fuel burn, minimizing renewable curtailment, and reducing unexpected scarcity pricing.

Reducing energy costs

Storage provides ERCOT with fast, flexible, and dispatchable generation. These features help meet growing ancillary services requirements and absorb volatile real-time energy market prices. This mitigates costly price spikes caused by either scarcity or the slow ramping of ERCOT’s aging thermal fleet.

For example, on August 17, 2023, supply was tight between 3 and 8 pm due to elevated power demand and weak wind energy generation. Power prices surged to $5,000 per kilowatt-hour, the maximum amount allowed by ERCOT. The battery fleet discharged 1.8 GW of power onto the grid, cutting energy prices by almost 50%, to around $2,700 per megawatt-hour.

Energy price volatility in ERCOT has increased in recent years due to factors including more volatile gas prices, extreme weather, generator and transmission outages, congestion, higher loads, and more variable renewable energy. That renewable variability tends to manifest in real-time energy market price spikes of over $100 per MWh, as shown by the chart below.

The chart shows price spikes have increased roughly in parallel with renewable penetration and increasing load. Storage is uniquely capable of charging when the prices are low and discharging when the prices are high. They are ideal arbitrage machines that cushion the volatility generated by increasing levels of renewable energy. As storage enters the market en masse, we expect the number of price spikes to flatten or even decline, thereby helping to manage overall system costs borne by ratepayers.

It’s time to charge up Texas

The storage age is here, but that doesn’t mean it has been fully embraced by Texas’ grid operators and policymakers.

For example, despite its increasingly important role in keeping the lights on, storage is excluded from a new capacity product called the production credit mechanism. If storage performs when the grid needs it most, it should be compensated in the same way that traditional thermal generation is. Furthermore, storage is excluded from applying for low-interest loans available from the new Texas Energy Fund, which is reserved primarily for new natural gas generation.

But now is the moment to embrace the technology. Storage provides enormous value to Texas in maintaining reliability and integrating clean renewable energy. And most importantly, it’s been proven to reduce power market costs and enable the deployment of clean renewable energy.

David Millar is a senior manager of market development and Duytam Vu is an electricity markets and policy analyst at Wärtsilä Energy. The opinions represented in this contributed article are solely those of the author, and do not reflect the views of Latitude Media or any of its staff.

.jpg)